CoreWeave: Despite Massive Tail Risk, Big AI Upside Ahead

Welcome to issue #001 of The Disciplined Growth Investor. Every Saturday morning, I send a free top stock idea report to your inbox. If you would like access to all of my top stock idea reports, and my complete Disciplined Growth Portfolio, consider becoming a full member.

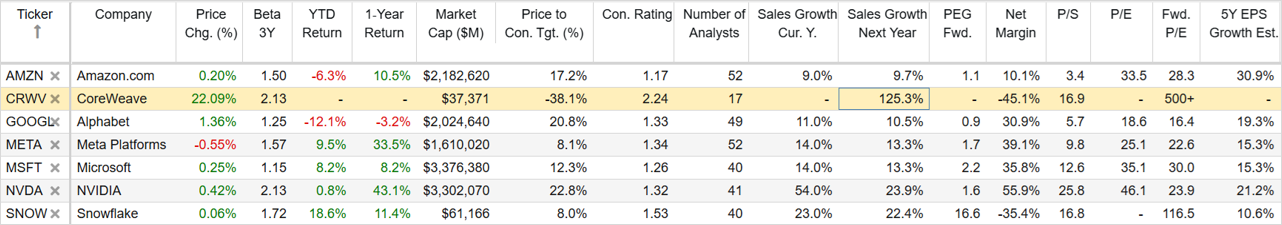

Generative-AI cloud platform, CoreWeave (CRWV), announced exceptional revenue growth this past week. And the company is delivering on its mission to help hyperscalers, such as Microsoft, get up to speed quickly with early access to leading Nvidia GPUs. And even though the shares likely have dramatically more price upside ahead, there is one massive tail risk investors need to be aware of.

Before getting into the dangerous tail risk, let’s quickly review what this company is and why it is growing so fast (and likely to keep growing fast).

About CoreWeave:

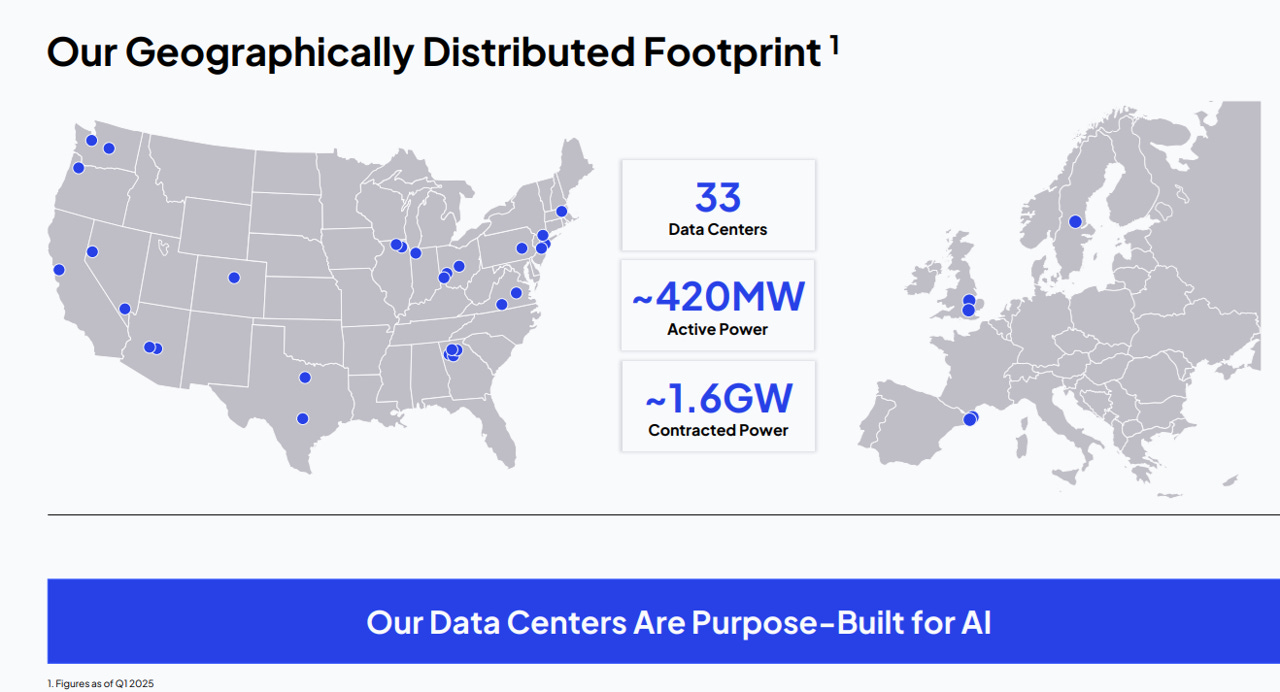

CoreWeave (CRWV) is an AI-focused hyperscaler providing a cloud platform optimized for generative AI workloads (it started trading publicly on March 28, 2025 via IPO). And unlike traditional cloud providers, its infrastructure supports GPU and CPU compute, storage, networking, managed services, and more, tailored for AI model training, inference, and VFX rendering. And with 33 purpose-built data centers, CoreWeave leverages Nvidia GPUs to deliver scalable, high-performance solutions for enterprises and AI labs.

Surging Revenues:

The short answer is that CoreWeave revenue is surging because of the massive AI megatrend. For some perspective, CoreWeave just reported $982 million in Q1 revenue (exceeding street estimates of $853 million) and representing 420% year-over-year growth (wow!). The company also raised guidance, forecasting $4.9B–$5.1B for FY 2025 revenue, representing an impressive 363% growth. Also important to mention:

CoreWeave secured a $4 billion contract with open AI during Q1, thereby boosting it revenue backlog to $25.9B.

CoreWeave also recently acquired Weights & Biases, adding 1,400 AI labs and enterprises as clients, and enhancing its software and AI development capabilities.

Nvidia owns a 7% stake in CoreWeave

The Big Tail Risk…

The traditional saying in finance and investing is “high risk, high reward.” And in the case of CoreWeave, there is a very high risk underpinning its massive revenue growth and high share price upside potential.

and pardon my French, but…

…CoreWeave is a Classic “Sh!tCo”

Although not explicitly stated, a strong argument can be made that CoreWeave was created (or at least is experiencing massive revenue growth) because it is allowing the big boys (Microsoft, Meta, OpenAI and any other hyperscalers that want to join in) to unload their massive AI capex risks onto another company (i.e. CoreWeave).

Hyperscalers like Microsoft, AWS, and Google face immense capex pressures to build and maintain AI-optimized infrastructure, with billions spent annually on GPUs and data centers. CoreWeave, by specializing in GPU-accelerated cloud services, offers a tailored alternative that hyperscalers can leverage through partnerships or contracts, as seen with Microsoft’s role as a major client (contributing significantly to CoreWeave’s 2024 revenue). This allows hyperscalers to access scalable AI compute without directly bearing the full capex burden of building similar infrastructure themselves.

Note: Customer Concentration: 77% of 2024 revenue came from two clients (Microsoft and Meta), posing potential risk.

Why “Sh!tCo” Status Matters

CoreWeave’s Sh!tCo status doesn’t matter one bit to a lot of investors right now because the skies and clear and sunny (i.e. AI demand is growing dramatically). However, when growth eventually slows (and it will eventually slow) CoreWeave runs the risk of being burdened with dramatically more infrastructure than it needs.

CoreWeave May NEVER Be Profitable:

And since CoreWeave is NOT profitable (Q1 EPS was -$1.49), it runs the risk of NEVER being profitable. CoreWeave may eventually be nothing more than “the fall guy” for big tech, absorbing the capex losses when AI growth eventually slows. CoreWeave is essentially taking the risk off of Big Tech companies by basically forcing CoreWeave to hold the bag (for all the expensive AI datacenter infrastructure).

And in case you don’t know, when Sh!tCo’s fall—they fall hard.

The Bottom Line:

I have every expectation that CoreWeave shares will continue to rise rapidly in the months and quarters ahead (barring any dramatic new macroeconomic disruption—which is entirely possible, especially under the Trump Administration) as I also expect the AI megatrend to continue ramping up dramatically (demand still exceeds supply—the ideal situation for a business).

However, at the first signs that AI megatrend growth is slowing—you might want to reduce your exposure to these shares (because when they fall—they’re going to fall hard). Moreover, this is why if you are going to own shares, you’re going to want to consider owning them as only one part of a prudently-concentrated goal-focused portfolio.

Overall, these shares are very attractive (lots of upside), but they come with big risks. Be smart, and do what’s right for you.

If you enjoyed this read, the best compliment I could receive would be if you shared it with one person or restacked it.

If you want to join a community of disciplined growth investors, check out The Disciplined Growth Portfolio. You’ll get instant access to more top stock idea reports plus the holdings in my Disciplined Growth Portfolio.

🚀