Palantir: AI Revolution, 10 Top Stocks

Welcome to issue #006 of The Disciplined Growth Investor. Every Saturday morning, I send a free top stock idea report to your inbox. If you would like access to all of my top stock idea reports, and my complete Disciplined Growth Portfolio, consider becoming a full member.

While Wall Street has been bashing Palantir hard, the longs (including Wedbush Securities’ Dan Ives) have been right all along as the artificial intelligence (“AI”) megatrend continues. This report reviews Palantir in detail (including its wide-moat business model, AI growth trajectory, current valuation and risks), compares the shares to the other top 10 growth stocks in Ives’ new AI Revolution ETF (IVES), and then concludes with my strong opinion on investing.

Palantir: Climbing the Wall of Worry

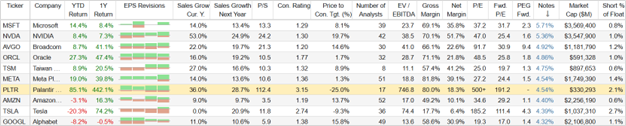

For some brief high-level color and perspective, you can see in the following table that very few Wall Street analysts have rated Palantir a “Buy” over the last three years.

Yet despite persistent high negativity, the share price has continued to climb dramatically and most negative Wall Street analysts updated their price targets only AFTER the gains (see chart below).

So congrats to the longs, who have owned the shares despite the negativity, and that includes Dan Ives who owns the shares (in a big market-cap-relative overweight) in his recently launched AI Revolution ETF (IVES); you can see Palantir among his top 10 holdings in the table below (the names are sorted by weight in the IVES ETF, as per the “Notes” column, more on the other names in this table later).

Also noteworthy, the green bars in the table above are upward EPS revisions from Wall Street analysts (this quarter, next quarter, this year and next year, respectively), thereby again demonstrating the strong earnings momentum for Palantir, much more so than other top AI stocks.

Palantir: A Wide-Moat Business Model

Palantir is an amazing, high-growth, software company benefiting from the big-data and AI revolution. It has expanded from its Gotham software platform serving government entities (which is incredibly difficult to break into, but highly lucrative once you have) to launching and rapidly growing its more commercially-focused Foundry software platform (despite a constant drumbeat of loud naysayers). And it also launched its AI Platform (“AIP”) right as the megatrend was beginning to ramp and thereby catching massive new business tailwinds that many previously thought impossible.

And what makes the company’s economic moat so impressive is that once you capture these types of customers, they are much more likely to expand the relationship than they are to end it (as evidenced by Palantir’s increasing net retention ratio, a key SaaS metric (Software as a Service) which was over 115% in 2024 (and increased every quarter)) and then climbed to 124% in Q1 2025. Plus, unlike other companies, Palantir actually builds high-quality customer solutions, as evidenced by this impressive quote from the company’s colorful CEO, Alex Karp:

"Also because the playbook backed by venture capitalists and supported by analysts has always been make the thinnest technology possible that is misaligned with your enterprise and hire the most and best salespeople so the enterprise gets moderate value while having its high revenue exported in a parasitic manner to the cheers of insiders and the pain of retail investors and we obviously rejected that."

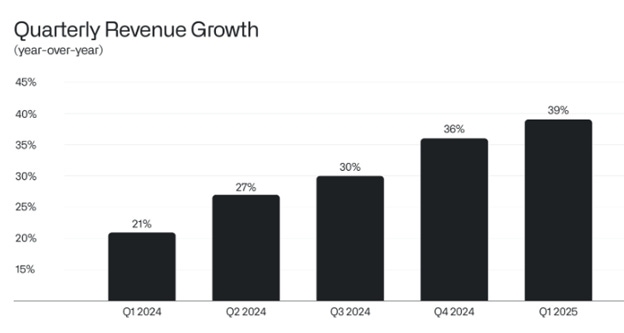

Additionally, you can see Palantir’s strong gross and net margins, and high expected revenue growth, in the earlier data table. Impressive. Also noteworthy, the company just became GAPP profitable in the last three years, and that net margin continues to expand as Palantir grows and benefits from economies of scale. In particular, SaaS is a great business (highly scalable) to begin with, and Palantir’s growth is being dramatically accelerated by the big data and AI megatrends (i.e. right place, right time).

AI Growth Trajectory

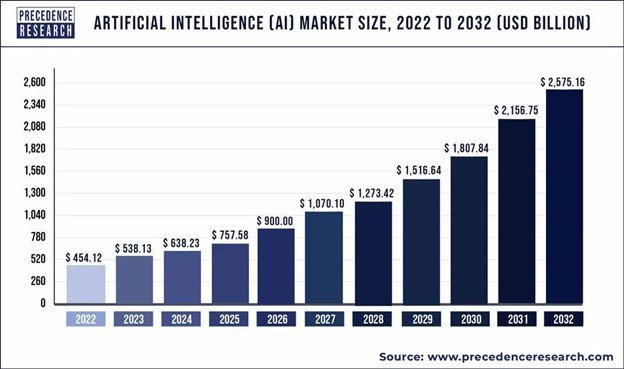

“Artificial Intelligence isn’t just another tech trend; it’s a generational shift, a technological wave on the scale of electrification or the birth of the internet.” That’s the view of Dan Ives (and his research team) and I agree. AI is a very big deal. It’s a megatrend.

For example, the following chart gives some flavor for the size of this opportunity in the years ahead (AI still has a lot of room to run).

The chart above suggests, that despite the strong gains we’re already seeing from top AI stocks (see our earlier table) there is still a lot of room to run.

And for perspective, here is a quote from Microsoft CEO Satya Nadella (another big AI player, but in the hyperscaler space):

“AI is the defining technology of our times. It’s augmenting human ingenuity and helping us solve some of society’s most pressing challenges.”

Current Valuation

You can see in the earlier table that Palantir is uber expensive on traditional valuation metrics like price-to-earnings (P/E) ratio and Price-to-Sales. Yet that has been the case for several years now, and it hasn’t stopped the shares from posting incredible gains (and the longs have made a lot of money, to the chagrin of Wall Street naysayers).

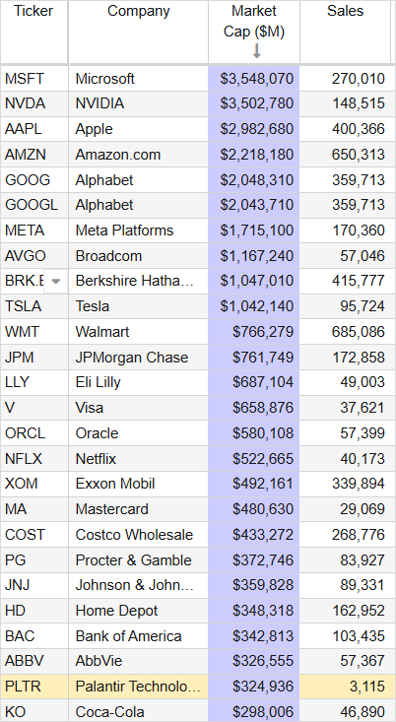

However, to put things in a little more perspective, here is a look at how Palantir now ranks in the S&P 500 in terms of market cap (it’s the 23rd biggest company) and in terms of sales (it’s only the 460th biggest). That’s quite a discrepancy, and a tribute to the market’s strong belief in Palantir’s ongoing sales growth.

Again, on traditional metrics, and even compared to its incredibly powerful growth trajectory, Palantir looks very expensive. But that hasn’t stopped the shares in the past from climbing higher.

The Risks:

In addition to a very rich valuation (as described above), Palantir faces several additional big risk factors that investors should consider.

Government Contract Dependence: Between 41% and 60% of Palantir’s revenue comes from government contracts (and 75% of that is US). And federal budget cuts are always a big risk (and they could have a very negative impact on Palantir in particular). That said, it seems the human workforce may be more at risk, as AI continues to shrink workforces around the economy. Nonetheless, this is a risk.

Reputational and Privacy Concerns: We saw just this month how quick Palantir was to respond to negative political rhetoric out of Washington DC. However, Palantir’s surveillance capabilities (used in military and immigration operations) are perceived as highly controversial by many, and these are ethical and regulatory risks that could alienate clients and/or investors.

Competition: Palantir’s faces competition from well-funded big tech, such as Microsoft, Amazon, and Google (which offer cloud-based analytics platforms with integrated AI capabilities, such as Azure, AWS, and Google Cloud, respectively). Further still, specialized data analytics companies like Snowflake, Databricks, and Tableau (owned by Salesforce) also provide alternative solutions that directly challenge Palantir’s Gotham and Foundry platforms. However, Palantir has been able to consistently overcome competition via its niche differentiation and thereby allowing high growth to continue. Also, the company’s long-term contracts and reputation for handling sensitive data have created high switching costs thereby adding additional resilience against the competition.

The Other Top 10 AI Revolution Stocks

You can see in our earlier table (which includes the top 10 names in the Ives AI Revolution ETF), Palantir isn’t the only high-growth megatrend play in town. For example, Nvidia has similar high growth (arguably better) and a significantly lower valuation (plus its graphics processing units are basically ground zero for the entire AI revolution). Also, Meta has better gross margins, a compelling P/E ratio versus its growth and a young CEO who seems dead set focused on building an even greater business. And if you look at analyst ratings and price targets (for what they are worth) all 9 of the other companies are more compelling than Palantir.

Also worth mentioning, the position sizes of the other nine companies in the AI Revolution ETF are much more consistent with their market caps and weights in the S&P 500 index. Whereas Ives is really going out on a limb with his top 10 bet on Palantir despite its relatively much smaller market cap and absolutely miniscule sales, relatively speaking. He (and all the other Palantir longs) have been very right with this bet thus far, and Palantir’s very-sticky high revenue growth remains on an impressive trajectory (thanks to its niche position in the AI megatrend, which still appears to just be getting started). You can view all 30+ holdings in the Ives AI Revolution ETF here.

The Bottom Line:

The AI megatrend is very real and Palantir is a truly exceptional company. If you are looking to play the AI megatrend more broadly, the Ives AI Revolution ETF is a quick way to get exposure to top names (and it has been gaining new assets/investors at a very fast pace). But if you are looking to avoid its 0.75% expense ratio, simply buying top names, such as Palantir, may be a better approach for you.

Personally, I have had tremendous success owning Palantir, and I am extremely confident in the AI megatrend (I currently own 12 of the names in Ives’ 31-stock ETF, with one new one very high on my watchlist).

However, at the end of the day, you need to do what is right for you. While Wall Street has been bashing Palantir hard, the longs have been right all along. And by trusting their own gut—and doing what's right for their own individual situations—they'll be right again!

If you enjoyed this read, the best compliment I could receive would be if you shared it with one person or restacked it.

If you want to join a community of disciplined growth investors, check out The Disciplined Growth Portfolio. You’ll get instant access to more top stock idea reports plus the holdings in my Disciplined Growth Portfolio.

My Personal top 10 AI Growth Stocks, Ranked…

Top 10 AI Growth Stocks (Ranked), Big Disruptive Upside

If you are getting AI revolution fatigue… don’t. While some names are more volatile than others, this megatrend is still just getting started and there are plenty of stocks that still have lots of disruptive upside. In fact, I rank and countdown my top 10 in this next report, starting with an “honorable mention” and finishing with my very top ideas.

Before getting into the specific names, it is important to remind you that investing is a goal-focused exercise, and everyone’s situation is different. You may want to consider a few of the names in this report as just one part of your prudently-diversified/concentrated portfolio. And if you are not a pro (or at least an expert-level investor) speak with an investment advisor or tax professional before you start investing.

So with that backdrop in mind…