Vistra: Trump’s AI Power Push, Pelosi’s Million Dollar Bet

Welcome to issue #007 of The Disciplined Growth Investor. Every Saturday morning, I send a free top stock idea report to your inbox. If you would like access to all of my top stock idea reports, and my complete Disciplined Growth Portfolio, consider becoming a full member.

Recent reports indicate the Trump administration is preparing executive orders to boost power supplies for the AI industry (i.e. easing grid connections and providing federal land for data centers). Vistra, the largest competitive power generator in the U.S., is uniquely positioned to benefit from this policy shift, with its diverse portfolio of nuclear, natural gas, solar, and battery storage facilities. Adding intrigue, former House Speaker Nancy Pelosi reportedly purchased ~$1 million in Vistra call options earlier in 2025, signaling strong confidence in its growth trajectory. This report dives into Vistra’s business model, its AI-driven growth, valuation, risks, and why it’s a compelling play in the AI energy revolution.

Vistra: A Powerhouse in the AI Era

Based in Irving, Texas, Vistra Corp is a Fortune 500 integrated retail electricity and power generation company with a staggering 39 gigawatts (GW) of generation capacity, making it the largest competitive power producer in the U.S. Its portfolio spans natural gas, nuclear, coal, solar, and battery energy storage, serving ~5 million customers across states from California to Maine. Vistra’s retail arm, including brands like TXU Energy, holds a 32% residential market share in Texas’ ERCOT grid, with NRG Energy as its main rival.

What sets Vistra apart is its strategic focus on reliable, dispatchable power—critical for AI data centers that require 24/7 electricity. CEO Jim Burke recently emphasized, “Natural gas and nuclear will play an ever-increasing role in the reliability, affordability, and flexibility of U.S. power grids for years to come.” This aligns perfectly with the AI boom, as data centers are projected to consume 6.7% to 12% of U.S. electricity by 2028 (that’s a lot!).

AI-Driven Growth and Trump’s Executive Orders

The AI megatrend is reshaping energy markets. Data centers, fueled by Big Tech’s AI ambitions, are driving U.S. power consumption to record highs, with 2025 and 2026 projected to set new benchmarks. Vistra’s shares have already soared 280% in 2024, outpacing Nvidia’s 178% and making it the S&P 500’s top performer. This growth is fueled by surging demand from AI infrastructure, advanced manufacturing, and electrification trends.

Trump’s reported executive orders to streamline grid connections and allocate federal land for data centers could supercharge Vistra’s trajectory. These policies aim to address bottlenecks in power supply, particularly for hyperscalers like Amazon, Microsoft, and Google, who are racing to build AI data centers. Vistra’s nuclear assets, like the Comanche Peak plant in Texas, and its natural gas fleet are ideal for co-located data centers, which demand reliable power close to generation sources. Vistra will likely be a key beneficiary, alongside peer Constellation Energy (CEG).

Vistra’s recent moves underscore its AI focus. In May 2025, it acquired seven natural gas plants for $1.9 billion, adding 2.6 GW of capacity at $743/kW—a bargain compared to new-build costs. The deal, expected to close by early 2026, enhances Vistra’s ability to serve high-demand markets like PJM and California. Additionally, Vistra’s nuclear fleet, the second-largest behind Constellation Energy, is exploring uprates to boost capacity by 10% by the early 2030s.

Valuation: Premium but Justified?

Vistra’s valuation appears rich, trading at ~24x forward earnings, nearly double the S&P 500 utilities sector’s 16x multiple. Its price-to-sales ratio is also elevated, reflecting high investor optimism. However, this premium is arguably justified by Vistra’s growth example revenue is expected to grow 19% this year).

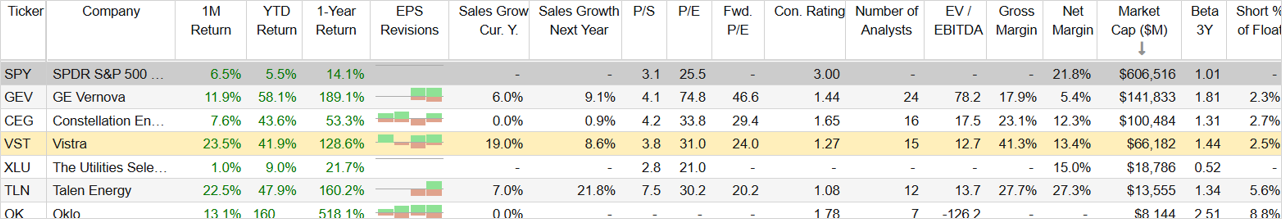

Wall Street remains bullish, with all 15 analysts rating Vistra a “Strong Buy” (1.27 on a scale of 1 (strong buy) to 5 (strong sell)). Further, upward EPS revisions (green bars in the table) for 2025 and 2026 signal underappreciated growth potential. Vistra’s capital allocation is also shareholder-friendly, with $6.3 billion returned since 2021 via buybacks and dividends, and $2 billion more planned through 2026.

Risks to Consider

Despite its strengths, Vistra faces notable risks. Environmental concerns are significant, as it was ranked the top U.S. CO2 emitter in 2020 and 2024, producing 1.5% of national greenhouse gas emissions. This could attract regulatory scrutiny or alienate ESG-focused investors. Customer concentration is another risk; while Vistra hasn’t secured a major data center deal like Talen Energy’s Amazon pact, its reliance on hyperscalers could expose it to contract volatility.

Competition from peers like Constellation Energy, which has inked deals with Microsoft, and NRG Energy poses a threat. Vistra’s failure to announce a data center deal has frustrated investors, contributing to a 20% stock drop in February 2025. Finally, industry cyclicality and regulatory uncertainty, particularly in Texas and PJM markets, could delay data center agreements.

Comparing Vistra to Peers

Vistra isn’t alone in the AI energy race. Constellation Energy, with its nuclear focus, surged 81% in 2024 and trades at a similar premium. GE Vernova, benefiting from grid upgrades, offers broader exposure but less direct AI leverage. Talen Energy’s Amazon deal highlights the potential for big contracts, but Vistra’s larger scale and diversified portfolio give it an edge. Unlike smaller players like Oklo, Vistra’s established infrastructure and cash flow ($4.56 billion in 2024) provide stability.

The Bottom Line

Vistra Corp is a standout in the AI megatrend, fueled by its unmatched scale as the U.S.’s largest competitive power generator and its strategic bets on nuclear and natural gas. Trump’s executive orders could unlock new opportunities, amplifying Vistra’s role in powering AI data centers. Pelosi’s $1 million investment underscores its allure, though her track record is no guarantee. Despite a premium valuation and risks like environmental scrutiny and deal delays, Vistra’s 280% surge in 2024, robust fundamentals, and Wall Street’s “Strong Buy” consensus make it a compelling pick.

Personally, I’m optimistic about Vistra’s ability to secure a game-changing data center deal, and its diversified portfolio mitigates cyclical risks. If you’re bullish on AI’s insatiable energy needs, Vistra is worth considering. But as always, weigh the risks and do what’s right for your portfolio. The AI energy revolution is just getting started, and Vistra is set to benefit.

If you enjoyed this read, the best compliment I could receive would be if you shared it with one person or restacked it.

If you want to join a community of disciplined growth investors, check out The Disciplined Growth Portfolio. You’ll get instant access to more top stock idea reports plus the holdings in my Disciplined Growth Portfolio.