Nvidia: 5 Channel Checks Ahead of Earnings

Welcome to issue #002 of The Disciplined Growth Investor. Every Saturday morning, I send a free top stock idea report to your inbox. If you would like access to all of my top stock idea reports, and my complete Disciplined Growth Portfolio, consider becoming a full member.

The most important company in the world right now is Nvidia (NVDA), and it’s set to announce earnings on Wednesday, May 28th after the close. Governments, other companies (large and small), and billions of people all rely increasingly on Nvidia’s computer chips directly and indirectly. And considering the massive Artificial Intelligence (AI) megatrend, demand for Nvidia’s Hopper (H100 and H200) and Blackwell chips dramatically exceeds supply (as incredible value-adding use cases are only just beginning to be discovered). This report reviews Nvidia’s business, growth potential, five important channel checks (suggesting Nvidia will surpass its revenue and EPS guidance), valuation, big risks, and then concludes with my strong opinion on investing.

Business Overview:

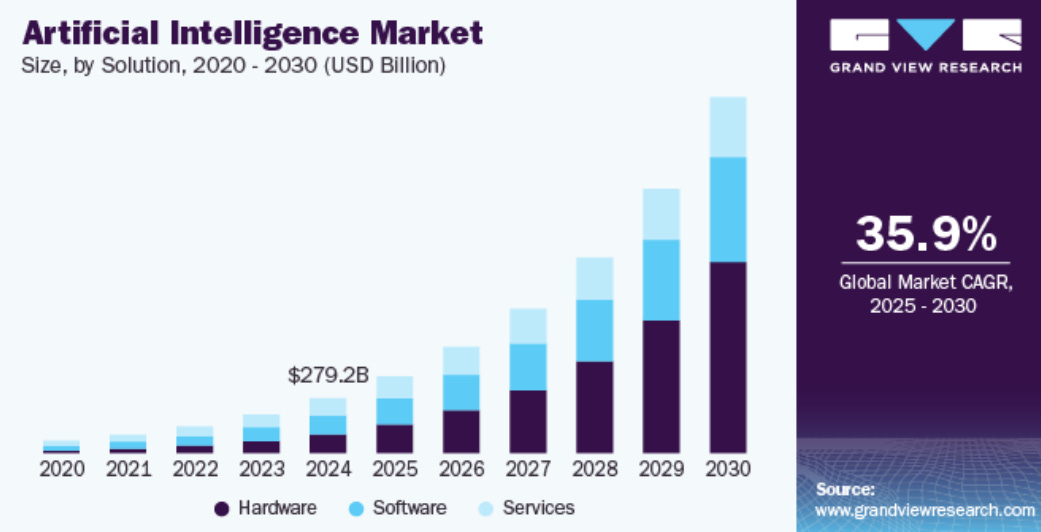

Nvidia is basically ground zero for the AI megatrend, a very large market opportunity that is already dominated by Nvidia (roughly 90% of all AI is run on Nvidia chips), and that market is expected to grow at nearly a 36% (CAGR) through 2030.

Specifically, Nvidia’s graphics processing units (GPUs), dominate in data centers, gaming, and automotive sectors, and the data center segment alone (basically where cloud AI happens) generated $39.3 billion in revenue last quarter (over 80% of Nvidia’s total revenue). Further, Nvidia’s CUDA software platform and DGX Cloud strengthen its AI ecosystem (moat) with partnerships across hyperscalers and neocloud providers (more on these partners later).

So with that backdrop in mind, let’s get into some Nvidia channel checks suggesting growth remains extremely robust.

Channel Check 1: Hyperscaler AI Investments

The AI hyperscalers (i.e. large scale cloud service providers with massive compute requirements) are demonstrating the demand for Nvidia chips is still accelerating.

For example, Meta (META) (a big Nvidia customer) just recently raised its 2025 capex estimate to $64–$72 billion, citing “hard-to-meet” AI compute needs. And Amazon’s is expanding its collaboration with Nvidia on AI for services like Bedrock. Further, Microsoft’s (MSFT) $80 billion FY2025 AI data center budget (with 52% capex growth), is driving demand for H100 GPUs in its Azure cloud platform. Further still, Elon Musk (TSLA) recently announced that his xAI will be implementing 1 million GPUs outside of Memphis (mostly Nvidia chips, some AMD chips) which basically equates to a $30-40B purchase order to Nvidia.

All of this recent information bodes well for Nvidia’s upcoming earnings announcement.

Channel Check 2: Neocloud Provider Growth

As another indication that Nvidia chip orders are outpacing forecasts, the neocloud providers (offering Nvidia GPU-based cloud services) are scaling very quickly.

For example, CoreWeave (CRWV), which started trading publicly in March, just reported first quarter revenue of $0.98B (420.3% year-over-year growth) with 70% tied to hyperscalers leasing Nvidia GPUs. CoreWeave also has a revenue backlog of $25.9B, and is in advanced talks with Alphabet (GOOGL) to lease Nvidia Blackwell chips to Alphabet.

As subscribers know, I wrote about CoreWeave, in detail, last week (it was issue #001 of The Disciplined Growth Investor.

Also, Nebius Group (NBIS), another neocloud provider, just reported $55.3 million in revenue (+385% year over year), driven primarily by the core AI infrastructure business (i.e. Nvidia). Further, private firms like Lambda, Crusoe, Nscale, DeepNight, CloudGenera, and TEN AI are all expanding. This all bodes well for Nvidia.

Channel Check 3: Wall Street Analysts

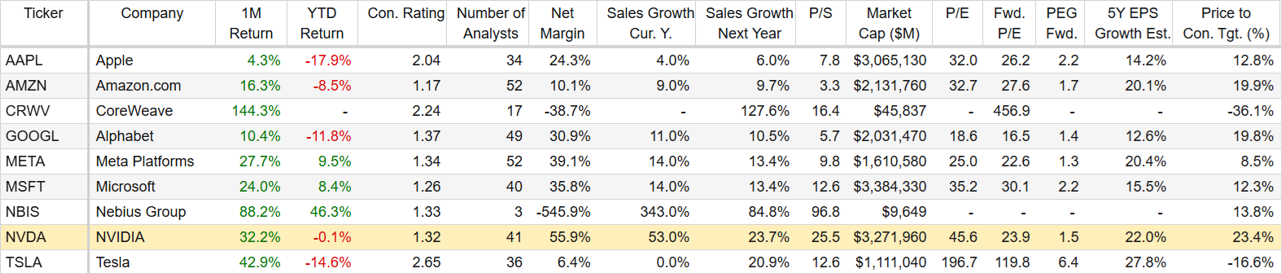

Analysts appear increasingly optimistic about Nvidia’s upcoming earnings. For example, Morgan Stanley recently noted a rise in Nvidia’s rack shipments to 1,500 in April from 1,000 in Q1, projecting 73% data center revenue growth. Also, Loop Capital reiterated a Buy rating on Nvidia noting that “Blackwell's autumn ramp up expectations will carry the stock.” And Raymond James just reiterated its strong buy rating on the shares. And as you can see in the table in the valuation section of this report, analysts rate the shares a “strong buy” (1.32 on a scale of 1 (strong buy) to 5 (strong sell)) and suggest more than 20% upside.

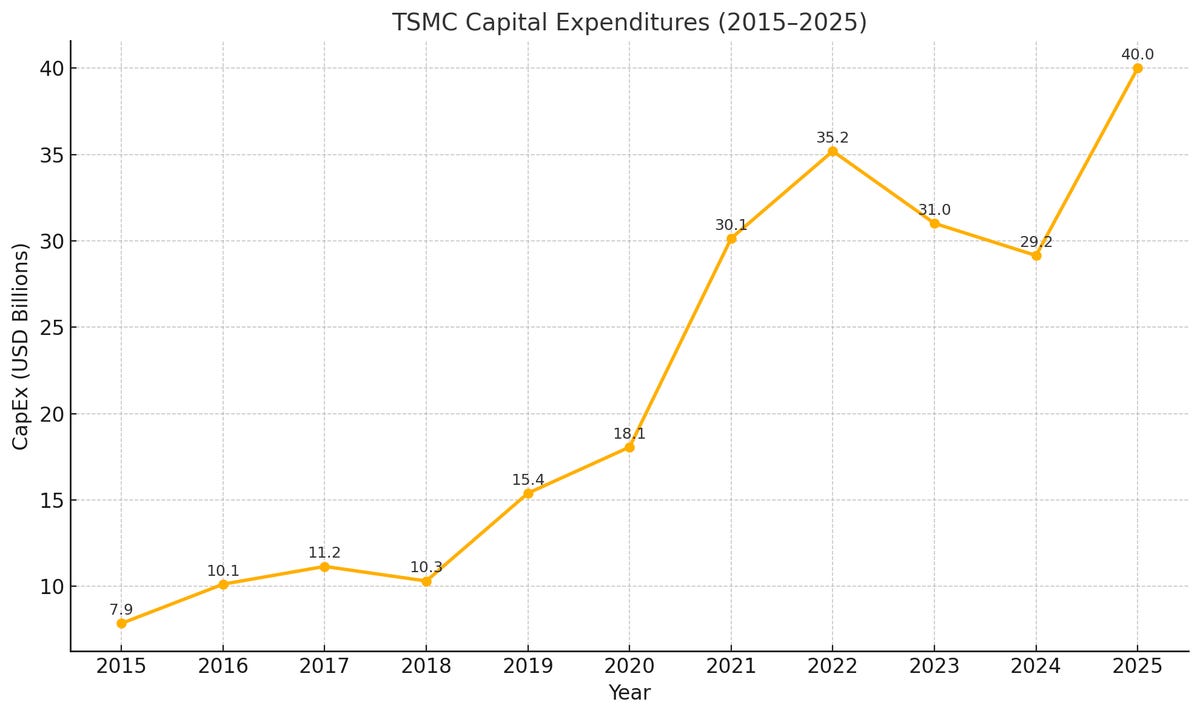

Channel Check 4: TSMC’s AI Chip Production

Taiwan Semiconductor (TSMC), Nvidia’s key foundry (i.e. outsourced chip producer), reported a Q1 2025 year-over-year revenue increase of 41.6% (in NT), while net income and diluted EPS increased 60.3% and 60.4%, respectively. And CEO C.C. Wei highlighted “insatiable” orders for Nvidia’s Blackwell GPUs. In fact, the company is now expected to spend between $38 billion and $42 billion on capex for 2025 (up from $29.2 billion in 2024); a good sign for the industry and Nvidia growth.

And the company’s April sales (up 22.2% month-over-month, and 48.1% year-over-year) suggest AI infrastructure ramp remains quite healthy (a good sign for Nvidia’s future).

Channel Check 5: Geopolitical AI Demand

Geopolitical dynamics are boosting Nvidia’s demand. For example, Saudi Arabia’s new $20 billion AI chip deal with Nvidia (along with a new AI “factory” partnership) underscore Middle Eastern interest in AI and Nvidia. Also, US onshoring efforts (backed by the Trump administration) have prompted Nvidia’s “several hundred billion” US-manufacturing commitment (also leveraging TSM’s $100 billion U.S. investment). So even though the US has imposed export restrictions of Nvidia chips to China (costing an estimated $5.5 billion in Q1), the business remains very much alive, well and growing from a bigger picture level.

Nvidia’s Current Valuation:

As mentioned, Nvidia remains very highly rated (strong buy) by Wall Street analysts (as you can see in the table below). It is extremely profitable (55.9% net margin), and remains compelling on a forward PEG (price/earnings to growth) ratio, especially considering its high growth, dominant market position, and the long legs of the ongoing AI megatrend. For reference, you can also see several of the AI hyperscalers and neocloud providers mentioned earlier in the table below.

Risks:

Geopolitics is perhaps Nvidia’s biggest risk right now, ranging from tariffs (as mentioned earlier) to international supply chain issues (the industry is highly cyclical and prone to delays resulting from supply and demand imbalances). Nvidia already recently announced a $5.5B hit from China tariffs (as mentioned), and considering US onshoring, middle east efforts, and the volatile tariff dynamics (considering who is in the White House) more volatility may persist.

Hyperscaler Concentration is another big risk. For example, 50% of Nvidia’s revenue comes from just a few clients, and any signs of spending slow downs could cause the shares to fall. However, as mentioned in the hyperscaler section of this report, the current growth environment continues to look promising, especially considering the healthy growth trajectory of the AI megatrend.

Competition: As mentioned, Nvidia dominates the AI GPU market with overwhelming market share and strengthened by its ecosystem (CUDA) moat. Nonetheless there is competitIon from AMD (AMD) and ongoing efforts by hyperscalers to develop in house chips. Not to mention the threat of new compute technologies, such as DeepSeek, which could dramatically shift the demand for Nvidia chips (i.e. enabling higher compute with less GPUs). Nonetheless, Nvidia remains the clear industry leader fueling the overwhelming majority of the dominant AI megatrend.

The Bottom Line:

It’s been a particularly volatile high-growth period for Nvidia, and the company is set to announce earnings on Wednesday, April 28th (after the close). Considering the strength of the AI megatrend (as described in the channel checks above) it seems likely for Nvidia to surpass the street’s ~$43B revenue and ~$0.83 earnings-per-share estimates. Not to mention, CEO Jensen Huang is a superstar at prudently and conservatively managing expectations (the company frequently outperforms). The real question will be any new insights on the short-term impacts of geopolitics (tariffs), the rate of acceleration for the Blackwell ramp (by how much is demand exceeding supply?) and the ongoing strength of the longer-term AI megatrend (which is perhaps one of the most profoundly disruptive technologies in some time). Long Nvidia.

If you enjoyed this read, the best compliment I could receive would be if you shared it with one person or restacked it.

If you want to join a community of disciplined growth investors, check out The Disciplined Growth Portfolio. You’ll get instant access to more top stock idea reports plus the holdings in my Disciplined Growth Portfolio.

🚀